Food Trade News

Gunn Exits Weis, Gleeson Named Interim VP-Merchandising; Lockard To Become CFO

Richard Gunn, senior VP-merchandising and marketing for Weis Markets has left the Sunbury, PA-based regional chain, effective immediately to pursue other interests. Gunn has served as Weis’ chief merchant since 2015 when he joined the company as senior VP from K-VA-T (Food City), Abingdon, VA.

Assuming the chief merchant’s position on an interim basis is Bob Gleeson, currently VP-perishables. Gleeson joined Weis in July of 2019 and has had a long career in the industry beginning with Shoppers in 1984 as a part-time grocery associate. During his 29-year career with Shoppers, which is based in Lanham, MD, he worked in increasingly senior leadership positions including VP-center store, senior-VP-merchandising and president of the discount retailer which is now owned by UNFI. Gleeson also worked closely with COO Kurt Schertle during his Shoppers career.

The company also announced other changes related to Gleeson’s newly elevated position. Industry veteran Steve Davis, formerly director of non-edibles/HBC/GM, now becomes director of edible grocery, dairy and frozen. John Evans will now oversee all of Weis’ HBC/GM and non-foods functions in addition to maintaining his role heading up private brands. Both Davis and Evans will continue to report to Brian Bosworth, senior director of non-perishable merchandising.

Weis also announced one other key executive change. Michael Lockard has been named the retailer’s new CFO, replacing Scott Frost who will retire on March 12. Lockard, a long-time financial retail executive, will become the company’s senior VP-chief financial officer and treasurer.

As Weis Markets’ CFO, Lockard will oversee the day-to-day management of the company’s accounting, auditing and financial functions. He will report to Jonathan Weis, Weis’ chairman and CEO. Lockard has more than 25 years of senior-level executive experience in retail, supermarket and supply chain companies, overseeing strategic planning, finance and accounting, information technology and global shared services. Previous industry jobs include stints at K-VA-T and Walmart.

“Michael Lockard is a seasoned financial professional with extensive experience in retail, particularly food retail. During his retail career, he has helped drive efficiencies and managed large, multi-discipline financial teams that have been a strong business partner to his respective companies’ merchant, supply chain and store teams. We are pleased to welcome him to our company and look forward to working with him,” said Weis. “We are also grateful to Scott Frost, our retiring CFO, and congratulate him on a successful 42-year career with our company. As CFO, he led our financial unit and developed a capable team that will position us for continued success going forward. We wish Scott all the best in his retirement.”

Garcia, Wiscovitch Acquire Associated Supermarket Group From AUA Private Equity

AUA Private Equity Partners, LLC (AUA), the hedge fund led by former Goya executive Andy Unanue, has sold its stake in Associated Supermarket Group LLC (ASG) to the retailer’s senior management headed by Joe Garcia, ASG’s chief executive, and Zulema Wiscovitch, the merchant’s executive VP and chief administrative officer (CAO).

Freedom 3 Capital and other investors provided financing for the deal.

ASG, based in Port Washington, NY, provides retail solutions to approximately 230 independently owned grocery stores in the New York Tri-State Area and other cities along the U.S. eastern seaboard, providing distribution, marketing, merchandising, promotional services, and store financing. Under the new structure, Garcia and Wiscovitch will share responsibilities as co-president and co-CEO.

Garcia, who has spent more than 40 years in the grocery business, first joined ASG in 2013 as executive VP. In January 2018, he was named chief executive. Garcia is well-known around the Metro NY area from his 17 years as an executive at White Rose, the former Carteret, NJ wholesaler that declared bankruptcy in 2014 and whose assets were subsequently sold to C&S Wholesale Grocers, which remains the primary grocery supplier to ASG’s stores.

Wiscovitch joined ASG in 2014 as executive VP and CAO. Prior to that she served as executive director of the National Supermarket Association (NSA), the trade association that represents independent supermarket owners in the Northeast and Mid-Atlantic regions.

AUA originally purchased ASG in December 2012 and helped restructure the organization from a family-owned business to an institutional company providing supermarket retail solutions and services to independent grocery operators. Under AUA’s ownership, ASG acquired four prominent New York supermarket banners (Associated, Compare, Met Foods and Pioneer), expanded its store footprint into contiguous geographies, built institutional systems and processes and recruited a new management team.

According to a spokesman, negotiations between the two parties began shortly after Garcia was promoted to CEO in 2018. No price was given for the transaction. Our research indicates that annual sales for ASG’s stores are approximately $1.7 billion.

Andy Unanue, managing partner of AUA Private Equity and chairman of ASG, stated: “I am very proud of how AUA Private Equity strengthened the value proposition of ASG during our ownership and delivered long-lasting benefits for independent grocers that operate stores in multicultural communities.”

Steven Flyer, partner of AUA Private Equity, commented: “Our investment in ASG reflects AUA Private Equity’s ongoing strategy of investing in family-owned companies where we can institutionalize a privately-held business, expand the company’s service offerings, and accelerate growth. Our sale to the company’s management team is a very good outcome for our investors, our management team, and ASG’s customers, and positions ASG as a leading provider of retail solutions and distribution to independent retailers.”

Garcia added: “I have enjoyed our partnership with AUA and I am excited to begin the next chapter for ASG under management ownership. We look forward to continuing to serve our customers, expand our footprint to other areas, and offer a tremendous value that positions the supermarkets we service ahead of their competition.”

Wiscovitch stated, “We are thrilled to embark on this journey as we envision ASG’s future of continued growth with an emphasis on retail excellence, an outstanding value proposition and innovation for the benefit of our customers, and our mutual success in the marketplace. We have a phenomenal team of people who are laser-focused on accomplishing our goals and growth objectives.”

2021 Retailer Outlook Panel

As we do each year, Food World reached out to several retailers in our marketing area, asking them to look ahead at some of the issues facing the industry in the coming year. This year’s panelists include: Rod Antolock, president of Harris Teeter; Rick Rodgers, president of Green Valley Marketplace/B. Green; Dan Croce, SVP-store operations for the East division of Sprouts Farmers Market; and Nicholas Bertram, president of The Giant Company. Our questions:

- Among many other things, the pandemic has wreaked havoc with supply chains and, ultimately, item availability. Assuming post-pandemic normalcy occurs later this year, what long-term changes in SKU rationalization do you foresee?

- Post-pandemic, how do you view overall vendor relations changing in such areas as top-to-top meetings, new item introductions, overall trade spending, etc.?

- With the COVID-19 virus came the need for extreme cleanliness at store level. What have you done to permanently change your sanitation and company-wide safety protocols?

- As the pandemic has changed many buying habits/patterns, ecommerce continues to be a growing platform. Did you make changes during the pandemic and what future changes do you anticipate for 2021?

Rod Antolock

President, Harris Teeter

- Retailers will continue to reduce assortment over the next couple of years—this will improve shelf efficiencies and improve DOS (days of sales) and COS (cases on shelf) for their stores. This will result in lower out-of-stocks as well as improved sales. Additionally, this reduction will have to be balanced with new item innovation.

- Top to top meetings should go back to normal once travel restrictions are lifted. It’s very important that retailers and suppliers meet at the highest level in person annually. However, quarterly meetings should be a combination of virtual and in-person meetings throughout the year. I believe post-pandemic new item introduction meetings should go back to pre-COVID routines; it is critically important to meet in person in order to discuss and evaluate all new item products. We expect overall trade spending to increase post-pandemic as competition amongst retailers is going to be fierce and we are going to expect heavy investment, keeping in mind that many suppliers saved trade spend during the pandemic

- One of Harris Teeter’s core values has been and will always be operating clean stores. Some of the enhancements to our usual strict sanitation procedures that were put into place due to COVID will likely remain in place and become part of our everyday standards. Some examples are wiping down self-checkout screens more often and other frequent touch points such as Frozen food and dairy door handles.

- As our business grew this year, we focused much of our efforts on ensuring adequate storage capacity for storing and staging orders. While most of this work is already complete on the easy-to-do stores, this year, our focus will be on “In the wall reset” to improve storage and staging orders where the opportunity was not readily available during the pandemic.

Rick Rodgers

President, Green Valley Marketplace/B. Green & Co.

- When we look at product assortment and supply chain issues there are many factors to consider. We had supply issues due to demand, manufacturing capacity, raw material challenges, COVID out-breaks that shut down plants and transportation/logistic gridlock. There was also a conscious effort by many manufacturers to reduce their assortment as a solution to meet demand on their core variety. It is the opinion of many wholesalers and retailers that most companies will only be bringing back a limited amount of those items and eliminate the others permanently. It has been extremely difficult to manage shelf integrity based on the plethora of supply issues and changing purchase habits due to the pandemic. Our team will be working continuously to rationalize our SKU assortment using our internal data and in partnership with our manufacturer and vendor partners.

- I think that even prior to the pandemic, vendor in-person meetings were going more virtual. New item introductions have also become more sell sheet and email based and the frequency and number of items has been more controlled. So, I think the trend to virtual interaction with customers has been accelerated by the pandemic. The cost and travel time coupled with a reduction in sales team staff was already dictating the transition for most companies and I think what we see is now the new normal. The interesting thing to look at as it pertains to selling, is how this will impact food shows and expos going forward.

- Cleanliness is always a good thing for grocery operators, and we have always prided ourselves on operating clean stores. With a pandemic it is more about a sanitary approach to protect both your employees and customers. We immediately wanted to take care of our associates and give them confidence they were protected at work. We installed plexi-glass at the registers, customer service and in all service departments where there was direct contact with customers. We provided gloves and face masks or face shields to all associates. As the pandemic continued, we allowed our associates to be creative and wear their own mask. We even had a contest at each store for the most creative and gave away gift cards. We placed floor graphics throughout the store promoting social distancing, directional signs in the aisles and queuing lines at the registers and service departments. We also offered hand wipes and sanitizer in multiple areas around the store. Cart sanitizing, register cleaning and a strict routine of store cleaning/sanitizing was in place and strictly enforced. The company followed all the CDC guidelines to the fullest as soon as they were made available and always took the approach of extreme caution with every decision about our employees’ well-being. Our associates are hero’s in our minds and cannot be praised enough for their tireless efforts during this difficult time. One of the few positives to come from this challenge is confirmation of just how amazing our B. Green team is.

- To keep up with the continued use of eCommerce during the pandemic, we made several operational changes. The number of slots available daily to customers for both pickup and delivery was dramatically increased to keep up with demand. This required the need to both hire additional employees and cross-train existing employees to assist in order picking and processing. Administrative changes were also made to improve the customer interaction on the eCommerce website and also improve our ability to do suggestive selling to ensure we captured what would have been impulse sales in store. Current plan for 2021 is to continue to invest capital in technology and infrastructure to improve order processing efficiency and increase profitability on eCommerce orders which necessitate more labor. These investments will also improve the turn time of the order process and result in an overall better customer experience.

Dan Croce

SVP-Eastern Division, Sprouts Farmers Market

- We’re committed to serving our customers coast to coast the good-for-you groceries they rely on Sprouts for throughout the pandemic. Our team members take great pride in serving the community as they are working hard to process new shipments and keep shelves well-stocked with fresh and healthy foods along with essential vitamins and supplements to support overall health and wellbeing. Additionally, we continue to work with our long term vendor partners and collaborate to help fortify the product pipeline not just in the short term, but long term through all quarter of 2021. Partnership and clarity in planning has served us well and look to fortify these consistent efforts by both Sprout and our partners every day.

- As Sprouts continues to grow, we’re committed to growing our relationships with niche vendors to bring their unique, quality products to the millions of shoppers who visit our stores every week. Being a people powered business, we are very serious about the safety of our team members, our partners, and our customers. We continue to invest in our differentiated assortment by meeting new vendors through virtual events and growing innovation with our current vendors though deepened relationships. As we all learn every day and hypothesize what post pandemic will be like, we are committed to forging our relationships with current and future partners.

- Operationally, many of the health safety procedures you see in-store are here to stay. They are a good thing for the industry going forward. The scope of where we clean and how often we clean has dramatically ramped up and Sprouts is one of only a few retailers to join Ecolab Science Certified program. The program combines advanced chemistries with new public health and food safety training and audit validation to deliver a higher level of cleanliness.

- Ecommerce is a natural way for Sprouts to engage with our customers and offer them broader access to healthy foods. We now also offer pickup in all our major markets after swiftly expanding our pickup service from 55 stores to 344 stores in a matter of weeks. As the country continues to practice social distancing, Sprouts’ grocery delivery and pickup sales have remained elevated.

Croce added some information about the retailer’s growth plans as well: “In 2021, Sprouts will open a similar number of new stores as we did in 2020 and we will introduce our smaller store layout of 21,000 – 25,000 square feet and a new format design and layout in several stores. We will also add distribution centers targeted to be within 250 miles of each store ensuring the freshest products for our guest.”

Nicholas Bertram

President, The Giant Company

- No question that the industry faced supply chain challenges this year but through them, I believe we gained valuable long-term learnings that will serve our company, supplier partners and our customers in the future. What our customer needed this year was very different than in years past. We saw that category availability was more important than specific item or flavor for most of the year. As we move forward it will be important to get those favorite brands and flavors back, but with more focus on item variety versus size variety. An important part of what we do at The Giant Company is simplifying shopping for our customer and being there for her, whenever and wherever she needs us. Continuing to refine our store segmentation, in conjunction with our partners at RBS and PDL will help us continue to hone the assortment on a store-by-store basis.We saw more of our customers preparing meals at home, and we believe this will continue well into 2021. We have doubled down on our efforts to support this trend, with our dedicated “All Set” meal program, which will continue to give our customer the solutions they need to make the most of their family meals, where ever they may be. We are cautiously optimistic that the industry supply chain will continue to improve every day.

- While we were all thrust into this virtual world, there was a quick realization that business could still be conducted, and be effective, without physically being face to face. With the introduction of vaccines, we are hopeful that travel restrictions will ease and at some point, we are able to return to certain face to face meetings. Top-to-top meetings have long been a very important part of our industry and they will continue to be, but the content and physical locations will look different. Specifically, as 2021 gets underway, both sides will need to have more conversation around supply chain as well as e-commerce. While the industry saw a decline in promotional spending in 2020 based on product availability, The Giant Company is planning an aggressive commercial plan in conjunction with our vendor partners and we anticipate the need for increased promotional activity and consumer.

- Our stores had rigorous safety protocols in place prior to the pandemic so we were able to leverage our safety program as a building block to enhance safety throughout our facilities. Some examples of these enhancements were adding plexiglass at checkout lanes, redesigning workflow to promote social distancing, supplying and requiring face mask usage by all team members. In terms of sanitation, we’ve always taken pride in the cleanliness of our stores. We’ve leveraged an already strong cleaning and sanitation program to add additional iterations of cleaning and disinfecting throughout the day further ensuring the safety of our team members and customers. This includes additional disinfection of high touch surfaces throughout the store. Some of these changes may be temporary in nature and will be assessed when the pandemic subsides.

- As part of our evolution as an omni-channel retailer, we had been investing in and fortifying our Giant Direct business in 2019, so we were really well-positioned for the incredible demand for the online grocery services triggered by the pandemic. That preparedness allowed our team to focus on enhancing our offering to deliver an even greater experience and value to our customers. In fact, it is hard to find a time in which something on our site or within our ecommerce operations was not changing for the better, as we had to make sure we were constantly improving our customer experience and meet the increased demand.

As far as our ecommerce operations, we were extremely focused on increasing picking efficiency and increasing capacity. Contactless pickup and delivery was also implemented, to ensure the safety of our team members and customers. We also began our “Flyby” pilot, technology that let our stores know when a customer was pulling into the parking lot to pick up an order, to help reduce wait times.

On our website we implemented a Chatbot to help with customer service during their online shop. To help simplify the shop, we also digitized the high value clip coupons that have traditionally just been in our paper ad and took our very popular Scan It! App, for frictionless shopping, and integrated it into our core Giant app for a more seamless experience.

We also had our Cyber Days promotion for the second year in a row. The week after Thanksgiving, Giant Direct featured an exclusively online promotion. Beginning on Cyber Monday, customers could shop 65+ BOGO’s, with the opportunity to save over $100 with these online only deals. This program was built in partnership with our valued CPG partners, and we could not be more proud of the results.

As we look to the year ahead, accepting SNAP benefits online is a major priority to deliver on our promise of connecting families for a better future and making it easier than ever for all customers to share a meal together. And we’ll continue to improve our online customer experience by reducing customer wait times and bringing more value online through special online exclusive events with our CPG partners.

FTC Grants Approval Of Acme-Kings/Balducci’s Deal

Nearly 90 days after it was named the successful bidder for 27 Kings and Balducci’s stores at a U.S. Bankruptcy Court auction in New York, Acme Markets received clearance from the Federal Trade Commission (FTC) to complete the $96.4 million deal.

The FTC allowed all 27 stores that Acme purchased to remain intact and the deal is formally expected to close by the end of January. It is expected that Acme Markets, a division of Albertsons, will continue (for now) to operate the 19 Kings and eight Balducci’s stores as a separate division with the upscale regional chain operating from its Parsippany, NJ headquarters and with most of its approximately 125 headquarters associates becoming Acme employees.

However, sources told us that Acme will review all aspects of the deal and, after analysis, changes are likely in the June-August period. And unlike the phase-in protocol that was originally planned where Acme was going to purchase and convert about five stores a week over a five-week period, the Malvern, PA-based chain will now acquire all 27 stores at the time of closing and all stores will remain open and continue to carry the Kings and Balducci’s banners (see the list of stores that Acme is acquiring and the five stores that KB US Holdings is looking to sell below).

To review the course of events that led up to the FTC ruling, let’s begin on August 23, when Kings/Balducci’s owner KB US Holdings (part of Qatar-based GSSG Capital), filed for Chapter 11 bankruptcy protection.

At that same time, it was announced that New York private investment firm TLI Bedrock, which offered $75 million for the regional chain and was deemed best bidder at the time, was officially granted stalking horse favorable status by the U.S. Bankruptcy Court (Southern District of New York) prior to a formal auction of the retailer’s stores.

TLI Bedrock, which had a 30-day window of exclusivity to negotiate with Kings/Balducci’s five UFCW labor unions (Locals 342, 360, 371, 1464A and 1500) that began on July 13 to hammer out potential changes in existing labor contracts and pension funds, failed to reach agreement. TLI Bedrock termed the bargaining as an attempt to “modify a few discreet, minimal and limited” aspects of their labor agreements. The unions saw it differently especially when the hedge fund tried to create a new annuity-driven pension plan in an attempt to especially separate itself from the large shortfall in its largest plan with UFCW Local 360.

Union officials told us that despite the significant shortfall in the Local 360 plan, they were wary of a new owner that was seeking more than “moderate” change. One union official also said that he was not confident that another new private equity owner without supermarket experience was capable of leading Kings and Balducci’s (prior to KB US Holdings, the retailer was controlled by New York investment firms Angelo Gordon & Co and MTN Capital). About 1,900 of the retailer’s approximately 3,000 associates are unionized.

At the formal auction, which was held virtually on October 14, Acme stepped up and outbid TLI Bedrock by a substantial margin and was awarded the 27 stores it bid on (there were originally 34 stores in the entire lot, but seven stores were not part of the auction. KB Holdings is seeking buyers for those stores). A key reason for Acme’s interest was the relationship that it and Kings had with the United Food and Commercial Workers. In particular, one UFCW Local (360) whose members are part of a multi-employer pension plan that is currently about $60 million underfunded. The only two retailers that remain in that plan are Kings and Acme (other retailers that have gone out of business or sold their stores were also previously part that plan). If TLI Bedrock were to acquire Kings/Balducci’s and negotiate a new separate plan (which the hedge fun tried to do), Acme would be the only retailer supporting that pension fund with nothing to show for it.

With the acquisition, Acme adds an additional 27 stores to its 175 Mid-Atlantic store base. However, there will be challenges, including purchasing a retailer that, because of substantial debt, has been unprofitable despite strong retail sales across the industry that have been aided by the impact of COVID-19 shopping habits. In the 52-week period ended July 20,2020, Kings/Balducci’s posted an $8.6 million loss on sales of $590 million.

Kings Food Markets That Acme Will Acquire

Boonton, NJ

Chatham, NJ

Cresskill, NJ

Florham Park, NJ

Garwood, NJ

Hillsdale, NJ

Hoboken, NJ (Shipyard Lane)

Livingston, NJ

Mendham, NJ

Midland Park, NJ

Morristown, NJ

Short Hills, NJ

Summit, NJ

Upper Montclair, NJ

Verona, NJ

Whitehouse Station, NJ

Garden City, NY

Old Greenwich, CT

Balducci’s Food Lovers Markets That Acme Will Acquire

Alexandria, VA

Bethesda, MD

Greenwich, CT

McLean, VA

Rye Brook, NY

Scarsdale, NY

Westport, CT

Baltimore, MD (To-Go)

Stores That KB Holdings Is Attempting To Sell

Bernardsville, NJ

Hoboken NJ (River St.)

Maplewood, NJ

Ridgewood, NJ

Warren, NJ

Food Lion Unveils $212.5 Million Mid-Atlantic Stores Upgrade Plan

Last month Food Lion completed a $212.5 million investment to remodel 112 stores across Delaware, Maryland, Pennsylvania, Virginia and West Virginia. With the completion of this project, Food Lion has now completed upgrading more than 90 percent of its store base of more than 1,000 units in 10 states. Of the 112 remodeled units, 52 are in Maryland, 27 are in Virginia, 19 in Delaware, 10 in West Virginia and three in Pennsylvania.

The Salisbury, NC-based Ahold Delhaize USA brand also hired more than 2,300 associates as part of the store revampment plan. According to an economic impact study done by Towson University’s Regional Economic Studies Institute (RESI), the store improvement effort will generate $360 million in economic impact across the 112 Mid-Atlantic towns and cities these Food Lion stores serve. In addition to the added jobs and economic impact, Food Lion’s remodels are expected to boost state and local tax revenues by $40 million across the five states.

“Nourishing our neighbors in the towns and cities we serve is core to everything we do, and we’re excited to welcome customers to their fresh, new Food Lion,” said Meg Ham, president of Food Lion. “Neighbors, many who have shopped in their local Food Lion for decades, are now able to enjoy a new grocery shopping experience through the significant investments in our stores, associates and communities. From our expanded variety and product assortment, to a more efficient check-out experience, every change we’ve made will make it easier for our customers to find the quality products they have come to expect from Food Lion. When coupled with our everyday low prices and weekly sales and promotions, customers will see that we have made it easier for them to nourish their families with everything they need on a budget.”

Among the changes customers will see:

- Expanded variety and assortment across all departments relevant to its customers in each store.

- More local items in its “Local Goodness” section.

- An expanded variety of craft beer and limited reserve wines.

- More natural, organic and gluten-free items.

- An abundant selection of fresh produce and meat backed by Food Lion’s double-your-money-back guarantee and a larger selection of Nature’s Promise beef, pork, poultry, milk, eggs, bottled water, cereal, coffee and other items.

- A greater selection of easy and affordable meals for families and a wider variety of grab-and-go items and pre-sliced deli meats and cheeses, which are sliced fresh daily and available for customers to pick up without waiting in line.

- A more efficient checkout process.

- Fully-remodeled stores featuring new signage and groupings of like products, to make it easier to locate items faster.

- Additional safety equipment and protocols to provide a safe and clean environment

- Approximately 40 percent of these remodeled stores now offer Food Lion To Go, Food Lion’s grocery pickup service. The convenient service allows customers to place an order and pick up their groceries on the same day.

Additionally, many of these stores offer home delivery to allow customers to have their Food Lion groceries delivered to their doorstep in as little as an hour.

Also, consistent with Food Lion’s focus on fighting hunger in its local communities through Food Lion Feeds, the retailer has made considerable donations to local Feeding America member food bank partners in the region, including $100,000 to the Maryland Food Bank to sponsor the Supporting Wellness At Pantries (SWAP) Initiative to educate food donors, food bank partner agencies, and clients on the importance of good nutrition; $75,000 to the Food Bank of Delaware to purchase a refrigerated truck and food to for mobile market distributions to meet increased needs; and $60,000 to the Capital Area Food Bank to purchase food for mobile market distributions.

Additionally, Food Lion Feeds is donating $1,000 to every feeding agency that picks up food rescue product from each of these 112 stores, for an additional $112,000 in donations. This support is in addition to ongoing support these local organizations have received from Food Lion Feeds through other product, monetary, equipment and volunteer donations.

The 112-store remodeling effort encompasses more than 10 percent of the company store base. Food Lion began its “Easy Fresh & Affordable” rebranding/remodeling program in 2014 with the upgrade of 76 stores in the Greenville/Wilmington NC market. n markets closest to Baltimore-Washington, Food Lion refurbished 71 stores in the greater Richmond market at a cost of $110 million in 2017. A year later, it refreshed 105 stores in the Hampton Roads region at a cost of $178, and in 2019 the discount chain spent $40 million to improve its 23 stores in the Charlottesville/Harrisonburg area of Virginia.

All told, over the past six years, Food Lion has remodeled nearly 950 stores at a cost of more than $2.1 billion.

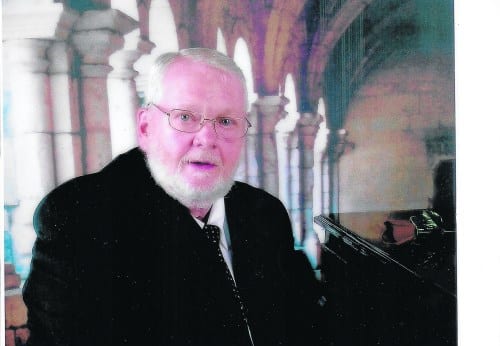

Former Redner’s Executive Pat Ferguson Passes Away At 82

Former Redner’s Markets executive Patrick J. “Pat” Ferguson, 82, of Macungie, passed away December 27, 2020 in the Lehigh Valley Hospital, Salisbury Twp., PA.

Ferguson was the first official employee of Redner’s Markets as he was the manager of the retailer’s Red Hill location when the late Earl “The Chief” purchased the store. During his 34 year career with the company, Ferguson (“Ferg”) served as a store manager and later as vice president of grocery, dairy, frozen purchasing. He retired in 2004.

Born in Dunmore, PA, Ferguson was the son of the late Martin and Anna (Lynott) Ferguson and step-son of the late Kathleen Ferguson. He attended Dunmore High School and served in the Pennsylvania National Guard. He was a life-member of the Hogan’s Social Club, Allentown, a past-president of the Allentown St. Patrick’s Day Parade committee, a member of the Ancient Order of Hibernians and a member of the Lower Macungie Lions Club. He was a member of St. Thomas More Catholic Church in Allentown.

Ferguson was the loving husband of the late Marian Ann (Maroni) Ferguson. Survivors include his children Deborah Klotz and her companion Wayne Remaley, Kathleen Ferguson, Phillip Ferguson and his wife Kim, Sean Ferguson and his wife Wendy; 15 grandchildren; and 16 greatgrandchildren with three more on the way; his sister Ann Marie “Nancy” Roscoe and sister-in-law Pauline Ferguson; numerous nieces, nephews, grandnieces and grandnephews. He was preceded in death by his son Martin, brother Bernard Ferguson and brother-in-law Walter Roscoe.

Redner’s Markets, in acknowledging Ferguson’s passing, wrote: “It is with sadness that we must say goodbye to our dear friend, Patrick Ferguson. Forever known simply as ‘Ferg’ he was Redner’s first ‘official’ employee! Throughout his 34 year career with Redner’s, Ferg touched the lives of thousands of guests as a store manager, vendors/business partners as a vice president and associates as a beloved mentor. His laughter was contagious, his love for his family/friends knew no bounds and his gift for singing was unmatched. The Redner Family forever thanks you Ferg. We are all lucky to have called you a friend and in the end. . .’You did it your way!’”

Condolences may be offered at www.jsburkholder.com. In lieu of flowers, contributions may be made in his memory to Joe’s Kids 6804 Anthony Road, Bethlehem, PA 18017.

Giant, Local Unions Reach Deal With PBGC Over Pension Plan

Giant Food, UFCW Locals 27 and 400 and the Pension Benefit Guaranty Corporation (PBGC) reached a final agreement on January 1 concerning Giant Food’s funding obligations with respect to two multi-employer pension plans: the Food Employers Labor Relations Association and United Food and Commercial Workers Pension Fund (FELRA) and the Mid-Atlantic UFCW and Participating Employers Pension Fund (MAP). As a result of this agreement, the PBGC has approved the merging of MAP into FELRA (the combined plan) and has agreed to provide financial assistance to the combined plan following its insolvency, which is currently projected to occur in 2022. The framework of the agreement was first disclosed when Giant (and Safeway) agreed to new four-year labor contracts in early March 2020.

Additionally, parent company Ahold Delhaize announced that it has completed its majority acquisition of New York City-based online grocer FreshDirect. That deal was first announced on November 18, 2020.

The new pension agreement is intended to resolve all of Giant Food’s existing liabilities with respect to the FELRA and MAP plans and improves the security of pension benefits for associates as well as reduces financial risk for Giant Food.

The Landover, MD-based retailer will invest approximately $800 million into pension benefits for approximately 18,000 associates in Maryland, Delaware, Virginia and the District of Columbia as part of this agreement.

In mid-December, another Ahold Delhaize USA brand – Stop & Shop – confirmed that it ratified a similar new pension agreement with Westbury, NY-based UFCW Local 1500 in which the Quincy, MA merchant would invest $229 million in the union’s new plan.

And earlier last month, Stop & Shop, Kroger and Albertsons made a $667 million investment in pension benefits to 34 Local unions (five other Stop & Shop Locals) that are switching to Variable Annuity Pension Plans (VAPP).

The pension-related investments announced by Ahold Delhaize during the course of the past year- including those plans of the UFCW National, Locals 1500, 400 and 27 – have greatly reduced Ahold Delhaize’s financial exposure to the multi-employer pension plans of its U.S. brands, Giant Food and Stop & Shop (ADUSA’s only unionized banners), the retailer noted.

The Zaandam, Netherlands-based retailer also stated those changes were achieved without impacting the 2020 financial outlook due to the strong financial performance in the year to date through Q3 2020 at Ahold Delhaize.

Recapping the agreement with Giant Food, the new deal consists of these components:

*Following the combination of FELRA and MAP, the PBGC will provide financial assistance to the combined plan to fund benefit payments up to the level guaranteed by the PBGC. Giant Food will pay the withdrawal liability to the combined plan in monthly installments, commencing in February 2021 for the next 25 years.

*Giant Food will create a new single employer plan to cover benefits accrued by the company’s associates under the combined plan that exceed the PBGC’s guarantee level following the combined plan’s insolvency (excess benefits).

*Giant Food will create a new multi-employer plan with Safeway to provide excess benefits for certain other participants in the combined plan for whom Giant Food previously assumed responsibility. Giant Food said it intends to exercise its option to withdraw from this plan, which is currently estimated to be approximately $10 million (8 million euros) in total, at some point during the next few years.

*Each of the above plans is a frozen plan, meaning that no further benefits will be accrued. With this agreement, Giant Food has significantly de-risked its pension exposure and has improved the security of pension benefits for plan participants. The above plans, in essence, remain defined benefit plans.

*With Giant’s $800 million there will be a corresponding reduction in the Ahold Delhaize FELRA and MAP multi-employer plan off-balance sheet liabilities. This pension-related liability will be recorded as a non-cash, pre-tax charge to pension expense, which will impact Q4 2020 results. This charge will be excluded from underlying results and will therefore not impact the previously issued underlying operating results outlook for 2020. On an after-tax basis, the charge amounts to approximately $554 million.

*Giant Food will also make contributions to a VAPP for future service benefits for Giant Food associates who are represented by UFCW Locals 27 and 400. The VAP as well as the above plans are designed to protect benefit accrual of participants, with a significantly reduced risk of plan underfunding and improved visibility on annual contributions.

*Specific to future financial impact, Ahold Delhaize said that total ongoing annual contributions to settle the combined plan and for the newly created plans are not expected to impact Ahold Delhaize’s underlying financial results going forward. The total impact to underlying net income does not differ materially to the impact from contribution amounts that have been in place for the previous plans, which totaled $37 million in 2019.

Moreover, Ahold Delhaize’s full year 2020 free cash flow outlook, as well as future free cash flows beyond 2020, are not expected to be materially impacted by these agreements.

As for Ahold Delhaize’s 80 percent stake in FreshDirect, FTC approval came after only six weeks of review. While neither merchant disclosed the selling price, several financial analysts pegged the deal in the $325-$350 million range.

Private investment firm Centerbridge Partners owns the remaining 20 percent of the e-commerce grocer which was founded in 1999. As previously reported, FreshDirect will retain its brand name and continue to independently operate out of its facility in New York City. The company will have seven directors on its board (five from Ahold Delhaize and two from Centerbridge. The directors are still unannounced.

Frans Muller, Ahold Delhaize’s CEO, said, “We are very pleased that we can now definitively welcome FreshDirect to our family of great local brands. This leading local online brand with a large and loyal following will help us reach additional customers in the New York trade area and further propel our omni-channel evolution. We are looking forward to working with our new FreshDirect colleagues.”

David McInerney, FreshDirect’s chief executive, who has been involved with the perishables-driven delivery firm from nearly its outset, noted, “Today marks the beginning of an exciting new era for FreshDirect. Ahold Delhaize will build on FreshDirect’s success ensuring the continued growth of our company, while creating synergy and maintaining the uniqueness of the brand. I am thankful to our loyal and devoted customers, many of whom have been with us since the beginning, and very proud of and grateful for the FreshDirect team, which has worked tirelessly over the years to make our company a leader in the field. The entire FreshDirect team looks forward to working together with our new Ahold Delhaize colleagues.”

C-Store Retailer QuickChek To Be Sold To Murphy Oil In $645M Deal

Convenience store operator Murphy USA, based in El Dorado, AR, has agreed to acquire another c-store retailer, QuickChek Corporation, in an all-cash transaction for $645 million. The purchase includes expected tax benefits valued at $20 million for a net after-tax purchase price of $625 million.

The transaction, announced on December 14, 2020, will be financed with a combination of cash on hand, existing credit facilities and new debt, and Murphy USA has obtained committed financing from the Royal Bank of Canada.

QuickChek, based in Whitehouse Station, NJ, was founded in 1967 as an extension of Durling Farms, a door-to-door milk and fresh dairy products delivery service that originally opened in 1888. It remains a family-owned chain of 157 stores located in central and northern New Jersey and the New York metro area, 89 of which offer fuel. Its total per-store sales average is among the industry’s best at about $3.5 million per unit including fuel.

Additionally, combined merchandise margins are 38 percent, according to the company, and food and beverage represents more than 50 percent of QuickChek’s overall mix.

The acquisition is consistent with Murphy USA’s updated capital allocation strategy as announced by the publicly-traded company in October. That strategy, according to Murphy USA, represents a continued commitment to deliver exceptional and sustained value to long-term shareholders and will complement other ongoing value creation mechanisms, including ongoing productivity improvement initiatives, organic growth, share repurchase and a dividend.

“In October we outlined an updated capital allocation strategy and committed to improving our food and beverage offer at existing and future sites,” said Murphy USA president and CEO Andrew Clyde. “This transaction greatly accelerates those efforts and benefits and is expected to provide reverse synergies across our network, while enhancing future returns on new stores. The transaction is also expected to create direct synergies that leverage our enterprise scale and our distinctive capabilities in fuel, tobacco and loyalty. We are excited to join forces with an exceptional and highly engaged team at QuickChek who share Murphy USA’s passion for delivering excellence every day to all our stakeholders.”

“QuickChek and Murphy USA both reflect a family heritage and a strong people culture,” said QuickChek CEO and chairman Dean Durling. “I am thrilled by Murphy USA’s commitment to honor our legacy and preserve our brand while learning from our business model. I am proud of what we have accomplished in making QuickChek what it is today and I am excited about the opportunities for continued growth and success in the next chapter in QuickChek’s journey. I know QuickChek’s dedicated employees and valued customers remain in good hands.”

In its announcement, Murphy USA noted that its net investment of $625 million represents a multiple of 13.2 times QuickChek’s estimated last 12 months earnings.

The Arkansas-based food and fuel merchant said annual run rate synergies of $28 million are expected to be achieved by the third year. When taking into account expected run-rate synergies and tax benefits, the acquisition reflects a multiple of 8.3 times the estimated last 12 months of adjusted EBITDA. The acquisition is projected to be accretive to earnings in 2022, the first full year of combined operations.

The transaction is expected to close during the first quarter of 2021, subject to customary closing conditions and regulatory approval.

In The Northeast, C&S, Wakefern, UNFI, Bozzuto’s Pace Wholesalers

The impact of COVID-19 had a major effect on sales and supply chains in all segments of the grocery business. The wholesale grocery channel was no exception as distributors struggled to keep their supply pipelines open during March, April and May, while also experiencing significantly higher volumes because of increased sales activity at their customers’ stores.

Leading the field once again was C&S Wholesale Grocers according to data compiled by Best-Met Publishing Co. The Keene, NH-based privately held wholesaler that supplies retailers such merchants as Stop & Shop, The Giant Company, Giant Food (all Ahold Delhaize USA banners), Tops Markets, Associated Supermarket Group, Foodtown, Gerrity’s, Geresbach’s and Key Food, had estimated wholesale revenue of $16.7 billion in the marketing area that ranges from the Carolinas to New England. The 12-month measuring period for the study ended November 30.

However, C&S’ perch atop the region’s wholesaler list may be in jeopardy beginning next year when Giant Food, The Giant Company and Stop & Shop will begin to transition into a self-distribution model that is scheduled to be completed by 2023. Another big customer, Key Food, has announced it will move to rival wholesaler UNFI late next year, too. And there was more C&S news to report: in October, chairman Rick Cohen tapped veteran executive Bob Palmer as the company’s new chief executive officer, replacing Mike Duffy, who was named C&S’ CEO in January 2018. Palmer returns after originally retiring from C&S as executive VP-chief procurement officer in September 2019 after 30 years with the wholesaler.

Ranking second among all retail distributors in the region was member-owned Wakefern Food Corp. which rang up an estimated $13.1 billion in wholesale volume. The Keasbey, NJ based co-op’s large volume is generated through the success of its more than 354 retail supermarkets under the ShopRite, Price Rite Marketplace, The Fresh Grocer, Dearborn Market, Fairway Market and Gourmet Garage banners in New Jersey, New York, Connecticut, Pennsylvania, Delaware, Maryland, Massachusetts, Rhode Island and Virginia, which includes dominant positions in the large Metro New York and Delaware Valley markets. Over the past year, Wakefern has added four-store Nicholas Markets (Maniaci family) to its roster that now operate as Fresh Grocer units, and its second largest member/owner, Village Super Markets, acquired five Fairway Markets (four in Manhattan and one in Westchester County). In 2019, Village also purchased three Gourmet Garage stores in Manhattan. And recently, the grocery co-op added its 51st member – Madison Foods – which operates three discount stores in the Boston area. Those stores, owned by the Slawsby family, were once Save-A-Lot units which will now operates under the Price Rite banner.

UNFI remained the third largest wholesaler in the market, with estimated volume of $9.2 billion in the Mid-Atlantic/Northeast region. The Providence, RI-based natural, organics and specialty food distributor grew significantly in 2018 with its acquisition of full-service wholesaler Supervalu for $2.9 billion. Since then, the organization has struggled. In 2019 it sold 13 of its Shoppers stores in Baltimore-Washington and closed six others; 24 more Shoppers stores are still on the block with little interest being shown by other operators. The past year has been markedly better, with much of its improvement fueled by sales during the COVID-19 pandemic. Additionally, former CEO Steve Spinner, who oversaw the Supervalu acquisition, announced that he will retire no later than July 2021. As previously noted, Key Food, the Matawan, NJ-based independent retailer co-operative, announced it has signed a new 10-year supply agreement with UNFI to service its 318 stores, most of which are located in the metro New York market. The estimated $10 billion deal becomes effective in late 2021 following the expiration of Key’s current contract with C&S Wholesale Grocers, and the opening of a new UNFI distribution center in Allentown, PA. Other key retailers supplied by UNFI include Redner’s, B. Green, Karns, Graul’s, McCaffrey’s and Western Beef.

Two of the largest national convenience store wholesalers – McLane and Core-Mark – dominated c-store distribution in the region. McLane’s 12 warehouses serving more than 6,000 stores (including many 7-Elevens) amassed estimated regional sales of $2.79 billion; and Core-Mark supplied more than 2,300 c-stores and amassed estimated annual wholesale sales of $2.01 billion.

Family-owned wholesale grocers, the genesis of virtually all grocery distribution, remained an important part of the landscape, despite tremendous industry consolidation and disruption.

Bozzuto’s, owned by the Bozzuto family, continued its tradition of strong customer service and innovation. The Cheshire, CT-based wholesaler serviced approximately 1,180 independent stores, many of which flew the IGA banner, from three distribution centers and rang up estimated wholesale sales of $2.2 billion in 2020.

Merchant Distributors, Inc. (MDI), owned by the George family, remained the leading wholesaler in the Southeast, serving more than 700 stores (including Lowes Foods, the regional chain of nearly 100 stores that parent firm Alex Lee owns). Annual wholesale volume is estimated at $2.03 billion for the Hickory, NC-based firm. Earlier this year, MDI added the nine-store group of independent retailers – Family Owned Markets – that operate supermarkets in Pennsylvania and Maryland.

Two metro New York based distributors – Krasdale (owned by the Krasne family) and General Trading (owned by the Abad family) – also fared well in this year’s survey.

Krasdale Foods, based in White Plains, NY, supplied many independent retailers under such banners as AIM, Bravo, C-Town, Market Fresh, Shop Smart and Stop 1 – whose combined sales paced all independent retailers in the five boroughs of New York City. All told, the company serviced approximately 3,050 stores in the metro New York and Philadelphia markets and accrued estimated sales of $1.6 billion this year. Longtime executive and current president and COO Steve Silver announced that he will retire at the end of the year and will be replaced by Gus Lebiak on January 1, 2021. Lebiak will be moving from his post as SVP/COO at Alpha 1 Marketing, Krasdale’s sales and merchandising arm.

General Trading, based in Carlstadt, NJ, also serviced many independent merchants doing business in the areas in and surrounding New York City. Of the company’s nearly 3,500 stores it supplied, many were ethnic and specialty customers. Annual wholesale revenue was estimated to be $641 million.

Burris Retail Logistics, another family-owned firm that dates to 1925, continued to be a dominant distribution and logistics company throughout the region. Along with supplying supermarkets and club stores through its Burris Custom Retail division, the Milford, DE-based organization operates a public refrigerated warehouse division (PRW Plus), a transportation company (Burris Transportation) and a foodservice redistribution business (Honor Foods). Its retail distribution entity, known for its expertise in temperature sensitive products, supplied about 550 stores (supermarkets and clubs) which produced estimated wholesale revenue of $610 million in 2020.

Rounding out the list of leading wholesale companies in the region are the three club store merchants that operate stores nationally. We have broken out store counts and estimated sales for those units which operate in our coverage area. The nation’s largest club store operator – Costco –led the pack in the Northeast, Mid-Atlantic and parts of the Southeast with 77 stores and $5.92 billion in annual sales (extrapolated to include only food and related products). BJ’s Wholesale operated the most stores – 101 – which produced annual estimated sales of $4.01 billion (extrapolated) while Walmart-owned Sam’s Club’s 45 stores amassed $1.65 billion in extrapolated volume this year.