Food Trade News

Personnel News From Weis Markets, FMI, NGA

Weis Markets announced the promotion of Nick Cicco to vice president of pharmacy. Prior to his promotion, he held the position of senior director of pharmacy operations.

In his new position, Cicco is responsible for pharmacy strategy development and overseeing the day-to-day merchandising, operation and management of Weis Markets’ 127 pharmacies. He is also responsible for managing the company’s team of dietitians. He reports to COO Kurt Schertle.

Cicco joined Weis Markets as a pharmacist in 2011. He subsequently advanced through positions of increased leadership responsibility including pharmacy manager, pharmacy supervisor, manager of pharmacy central services and Rx services support and director of pharmacy operations.

Cicco is a graduate of Wilkes University where he earned a Doctor of Pharmacy (Pharm. D).

FMI—The Food Industry Association recently announced the promotions of several key team staff members to elevated roles within the organization, furthering FMI’s commitment to serving the food industry.

Krystal Register, MS, RDN, LDN, has been promoted to vice president of health and well-being for her dedication and expertise in advancing initiatives that help connect the science of food and nutrition to overall health. Register has been especially instrumental in FMI’s participation in the White House Conference on Hunger, Nutrition and Health, developing industry commitments and measuring progress toward those goals. Register has also supported an evidence-based regulatory agenda, participating in and contributing to a robust slate of agency comments. She is a champion for registered dietitian nutritionists (RDNs) in the food industry and engages in advocacy to uplift the grocery store as a destination for health and well-being.

Diane Gill has been appointed to controller and vice president of financial operations. In her role, Gill will continue to spearhead financial strategies and operations with an added focus on leading the financial direction of FMI. Gill helps ensure the financial solvency of FMI and spearheads capital improvement projects that ensure systems are integrated, operate at high capacity and support FMI’s programs and services.

Steven Harris has been elevated to senior director of government relations and strategic initiatives. Harris’ deep understanding of policy and compliance issues, combined with his strategic vision, will further strengthen FMI’s relationships with government entities and drive impactful initiatives as he continues to advocate on behalf of the food industry.

Tom Cosgrove has been appointed director of industry relations. Cosgrove’s exceptional leadership and industry knowledge helps build strong relationships and community for food industry asset protection, technology, supply chain, risk and safety, and private brand professionals while advancing industry collaboration.

FMI president and CEO Leslie G. Sarasin said, “Our members recognize that the strength of FMI lies in its dedicated and talented staff and the pool of exemplary professionals we’ve promoted assures that our leadership trajectory remains stalwartly focused on the broader mission of the food industry. We commend these outstanding individuals for the accomplishments that secured their promotions, and we look forward to supporting their new and inspiring contributions offered on behalf of the food industry.”

The National Grocers Association (NGA) has named Caroline Sar its manager of marketing and member engagement.

Sar joins the NGA communications team in the Washington, DC office. She brings experience as a project manager, operations analyst and digital marketing analyst. Her duties will include creating and coordinating marketing strategies across the association, managing NGA’s websites, and developing marketing pieces to communicate with NGA members.

“Caroline hit the ground running as she joined the team shortly before the NGA Show, where she proved to be a great asset,” said Laura Strange, NGA chief communications and engagement officer. “We are confident that her skills will bring value to our team and our members.”

A native of North Carolina, Sar is a graduate of Wake Forest University with a bachelor of arts degree in economics, with minors in sociology and communications.

Additionally, NGA has promoted Max Wengroff to senior manager of government relations. Wengroff will become a junior lobbyist on NGA’s government relations team and help support NGA members on payments, tax, labor, sustainability and other policy issues.

Wengroff joined NGA in May 2022 as executive assistant to the government relations, industry relations and communications teams, and has served as coordinator of GR and membership. He was previously promoted to manager of government relations and membership.

“Max has shown an eagerness to get the job done right and a willingness to learn and grow in every role he holds,” said Stephanie Johnson, NGA vice president of government relations

FTC Strikes Again: Says Price Hikes Aided By Big Retailers

After reading the Federal Trade Communication’s (FTC) recently released “Feeding America in a Time of Crisis – The United States Grocery Supply Chain and the COVID-19 Pandemic,” one might get the distinct impression that some of America’s largest retailers including Amazon, Kroger and Walmart were the primary cause for the price increases and supply chain disruptions that occurred during the pandemic that began in early 2020 and continue to some extent today. The report also cited large wholesalers such as Associated Wholesale Grocers, C&S Wholesale Grocers and the McLane Co. as contributing to consumer price hikes and supply chain issues.

“As the pandemic illustrated, a major shock to the supply chain can have cascading effects on consumers, including the prices they pay for groceries. The FTC’s report examining U.S. grocery supply chains finds that dominant firms used this moment to come out ahead at the expense of their competitors and the communities they serve,” said FTC chairwoman Lina Khan.

The large federal agency began its investigation in November 2021 to analyze why prices were rapidly inflating and supply chain breakdowns were increasing. Twenty-eight months later that 20-page report (with another 28 pages of appendices) concluded:

- Some large purchasers pressed their suppliers for favorable allocations of products in short supply. At the outset of the pandemic, many companies suspended policies that would penalize suppliers for not filling orders of items that were in shortage. However, when suppliers could not fulfill every order, simply having product in stock became a point of competitive differentiation for wholesalers and retailers. To gain access to scarce products and therefore a competitive advantage, some companies—most often larger ones—used policies that imposed strict delivery requirements on their upstream suppliers and threatened fines for noncompliance. Walmart even tightened the delivery requirements its suppliers had to meet to avoid fines as the pandemic went on. In some cases, suppliers preferentially allocated product to the purchasers threatening to fine them, which may have affected competition between the companies that threatened these fines and those that did not. The potential for powerful retailers to distort product allocations during a shortage suggests that crises may create an opportunity for some firms to entrench their market power.

- Companies came to recognize that excessively consolidated supply chains were a liability. The pandemic revealed that concentration can undermine market resiliency and create market fragility. The stark impact of the supply chain disruptions during the pandemic prompted some firms to recognize the risks associated with having few suppliers available. Where a firm has many viable suppliers, the failure of any single supplier is less likely to disrupt operations. As a result, during the pandemic some retailers sought to diversify their supplier base, particularly of private-label (or store-branded) goods. Some larger firms purchasing in markets with few producers began exploring whether to build or acquire manufacturing capacity to reduce their exposure to concentrated markets. These efforts, however, have the potential to leave the remaining buyers even worse off if those large customers buy one of the few remaining producers rather than building that capability from scratch. Without policy intervention, markets that are fragile because of concentration may only further consolidate.

- When trade promotions designed to increase demand for products dried up, some firms were harmed more than others. Supply chain disruptions also changed dynamics in trade promotions, which for purposes of this study we define as any payment by a supplier for preferential access to downstream customers through the commitment of retail shelf space, product placement, or advertising. Trade promotions represent a significant revenue stream for many wholesalers and retailers. The reduction or withdrawal of these payments during the pandemic had a greater impact on retailers that were more dependent on promotional funds and made it harder for them to compete with rivals that used different pricing strategies. The significant size of trade promotions suggests further study of their economic impact may be warranted in light of their potential competitive impacts.

- Grocery retailer profits rose and remain elevated, warranting further consideration by the commission and policymakers. This study did not test whether the specific companies that received 6(b) Orders increased their prices by more or less than their input cost increases. However, publicly available data on general grocery retail patterns reveal that during the pandemic, one measure of annual profits for food and beverage retailers—the amount of money companies make over and above their total costs—rose substantially and remain quite elevated. Specifically, food and beverage retailer revenues increased to more than 6 percent over total costs in 2021, higher than their most recent peak, in 2015, of 5.6 percent. In the first three-quarters of 2023, retailer profits rose even more, with revenue reaching 7 percent over total costs. This casts doubt on assertions that rising prices at the grocery store are simply moving in lockstep with retailers’ own rising costs. These elevated profit levels warrant further inquiry by the commission and policymakers. The pandemic made clear that supply chain bottlenecks, which can be created or exacerbated by limited competition, can leave markets exposed to major supply chain shocks—and that those shocks, in turn, can allow major firms to entrench their dominance and further harm competition. Achieving more diversified supply chains, including through promoting competition, can both limit the severity of supply chain shocks and, in turn, reduce the opportunity for that entrenchment.

While the FTC report also puts partial blame on the role manufacturers played because of supply chain disruptions and subsequent price hikes, the country’s largest retailers bore most of the criticism in the FTC staff report (during its original investigating, the agency also reviewed documents and responses from three leading CPG companies – Procter & Gamble, Kraft Heinz and Tyson Foods).

The report also noted disruptions with labor supply, transportation/trucking, and with the availability of inputs and raw materials.

The report concluded by noting:

“The COVID-19 pandemic placed tremendous pressure on the supply chains that produce and move the nation’s food from farm to table. When unexpectedly put under sustained stress, there were not enough extra hands ready to pick up the work of sick colleagues, not enough spare trucks and truck drivers ready to haul more loads, and no easy way to suddenly ramp up production to meet surging demand. Bottlenecks were suddenly exposed as firms up and down the supply chain struggled to maintain their output and feed our nation. Some firms seem to have used rising costs as an opportunity to further hike prices to increase their profits, and profits remain elevated even as supply chain pressures have eased. Larger retailers and wholesalers with considerable leverage over their suppliers were able to take more aggressive action to protect themselves than were their smaller rivals. After widespread suspension of OTIF (On Time In Full) policies early in the pandemic, some large firms reimposed OTIF fines and penalties while the pandemic continued, pressing their suppliers to fill their orders or face large fines. In turn, smaller retailers and wholesalers without stringent OTIF policies were placed at a competitive disadvantage during the pandemic, when they received proportionally less product than their rivals. The sudden inability to obtain needed goods did sensitize industry participants across the supply chain to the dangers of excessive dependence on a small number of viable suppliers for critical inputs. As supply chains were disrupted, we observed firms across the supply chain beginning to examine alternatives to their existing suppliers with a new and more critical eye. Where concentration was highest, we observed retailers looking to protect themselves from markets that were excessively concentrated by considering vertically integrating to better control their supply of products. Shortages likewise prompted producers to reduce their funding of trade promotions. Promotions designed to increase sales made little sense when those producers were unable to meet existing demand. These changes affected retailers differently depending on their pricing model. Most notably, these trade promotions reflect a significant amount of money within the industry, and so the competitive impact of these differential effects (or of the promotions generally), may warrant further study. The supply chain disruptions during the pandemic provided insight into the competitive dynamics of the grocery industry. Limited competition can lead to bottlenecks that increase the impact of supply chain shocks on different businesses and consumers while simultaneously creating opportunities for further entrenchment. The potential for powerful retailers to distort product allocations during a shortage suggests that crises may create an opportunity for some firms to entrench market power. Similarly, retailers saw that they needed to increase the resilience of their supply chains when they faced markets with few producers, recognizing the value that markets with many producers bring to securing supply. As supply chains normalize, some of these symptoms may subside, but the underlying issues remain.”

One grocery industry trade association, NGA (National Grocers Association), applauded the FTC study. “This study confirms what independent grocers and their customers experience firsthand: dominant national chains or so-called “power buyers” are abusing their immense economic power to the detriment of competition and American consumers. In communities nationwide, independent grocers strive to compete on price, quality, service, convenience, and product range. However, decades of lax antitrust enforcement enable grocery power buyers to coercively squeeze suppliers to comply with their trade demands, unfairly disadvantaging smaller competitors.” NGA president and CEO Greg Ferrara added, “The result – confirmed by the FTC’s study – is a less efficient consumer supply chain where buyer power dictates priority distribution of high-demand products and special pricing arrangements.”

The NGA has long argued on behalf of its independent retail members that the nation’s biggest chains are getting bigger and more powerful because they are using their size to pressure suppliers, and taking advantage of arbitrary market segment loopholes to negotiate special pricing and package sizing of consumer goods that are denied to smaller competitors.

“COVID-era disruptions and food price inflation have made the grocery supply chain literally a kitchen table issue for millions of Americans,” said Chris Jones, NGA chief government relations officer and counsel. “This report highlights the urgent need for the Federal Trade Commission and Department of Justice to enforce existing laws like the Robinson-Patman Act, and for Congress to pass new laws that would level the playing field for grocery competitors for the benefit of the American consumer.”

However, one executive for a large corporate chain (and one that the FTC singled out for criticism) largely disagreed with some of the findings and context of the report.

“After reading the report, I won’t argue that some of the FTC’s conclusions are correct – especially in the areas of supply chain, labor disruptions and major transportation challenges,” he noted. “However, to blame America’s largest retailers for bearing the greatest responsibilities for price increases and other breakdowns wreaks of inaccuracy and prejudice. As for the NGA press release, I found it curious that they didn’t mention the role of AWG, C&S and McLane in supposedly creating price increases. Don’t AWG and C&S supply many of the independents who were supposedly adversely impacted by the alleged actions of their wholesalers? And yet they were allegedly complicit in hurting those same members? If you believe the report, you can’t have it both ways. I also found it hypocritical that the FTC would single out the overall dominance of Amazon and Walmart for their power and influence over pricing and supply chain leverage, but refuse to acknowledge that those retailers – and other non-traditional retail food sellers – should be considered when measuring the entire competitive landscape in evaluating market share in the Kroger-Albertsons recently rejected merger.”

Imperial Distributors Names Joe Kirby CEO; Michael Sleeper Becomes Executive Chairman

Imperial Distributors announced key organizational changes to its leadership team, effective April 1.

Michael Sleeper, who joined Imperial in 1964 and became president and chief executive officer in 1970, will transition into the role of executive chairman of the board. Michael’s entrepreneurial and visionary leadership and unwavering commitment to Imperial’s values have shaped Imperial’s success and influence in the industry. In his new role, he will continue to provide strategic guidance to the company’s board and management team. His wisdom and unparalleled experience will remain invaluable.

Joe Kirby, the current president, will succeed Michael as the new CEO. Since joining Imperial in 2003, Kirby has demonstrated exceptional leadership in a variety of roles in the organization. As CEO, he will leverage his deep industry expertise and dedication to operational efficiency and customer satisfaction to lead Imperial for long-term prosperity.

Naomi Sleeper, representing the third generation of the Sleeper family to lead Imperial, will assume the role of president and chief growth officer. Having joined Imperial in 2013, Sleeper has played a pivotal role in shaping the company’s strategic direction as executive vice president. With a focus on innovation, continuous improvement and sustainability, her leadership will drive sales and growth to ensure the company’s lasting impact.

“As we embark on this new chapter in Imperial’s history, I am confident that Joe and Naomi, working in tandem, will continue to grow our company with vision and purpose,” remarked Michael Sleeper. “I am excited for the journey ahead under their leadership.”

Kirby commented, “I am honored to take on the role of CEO and grateful for the opportunity to lead Imperial’s talented team. Together, we will continue to drive success for our customers, team members, and stakeholders.”

Naomi Sleeper stated, “It is a privilege to uphold our company’s legacy. I am committed to building on our strong foundation and leveraging the strength of our team to seize new opportunities and achieve sustainable growth.”

These organizational changes signify Imperial’s commitment to its tradition of excellence, enduring partnerships, and future prosperity, the company said.

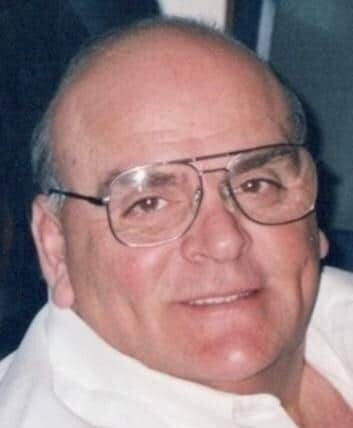

Independent Grocer Sam Marrazzo Dies Age 76

Sam Marrazzo, operator of Marrazzo’s Market in Ewing, NJ and a fixture in the Delaware Valley grocery industry for many years, passed away February 23 at the age of 76.

Sam will be remembered by his loving wife of 54 years, Margaret Marrazzo (Scott), daughter Mary Marrazzo Saltzman and her husband Josh and loving granddaughters Samantha Christine and Mary Catherine. He is survived by his brother Joseph Marrazzo and his family.

Sam was preceded in death by his parents and business partners Mary and Donald Marrazzo.

Sam was a graduate of Pennsbury High School and upon graduation immediately became involved in the family business at Marrazzo’s Quality Food Market on South Broad Street in Trenton, NJ.

Sam followed the legacy of his father, Donald, who began the Centre Fruit Market on Centre Street in Trenton in 1947.

In 1961, the family opened their second location, Marrazzo’s Quality Market on South Broad Street in Trenton. Don later made Sam a partner in the business, and they continued to run that store until it came time to expand. In 1989, they opened Marrazzo’s Thriftway in Robbinsville, which they sold about three years ago. The current 36,000 square foot supermarket in Ewing was opened in 2000.

Sam said the family personally managing the store had helped cut down on costs and improve customer service. “The good fortune we had came from 60 years of working hard,” he noted. “We still do.”

He was widely recognized and respected in the business world. He sat on the board of Yardville Bank and First Trust Bank in addition to the board of the Retail Marketing Group (RMG).

One of his greatest pleasures was greeting his customers each day. They became his friends, and he took a very personal interest in their stories. Everyone was aware of his high personal and professional standards. He always believed his customers deserved the best of himself and his employees. He truly was “Marrazzo’s Market.”

Donations in his memory can be made to St. Jude Children’s Research Hospital or to the charity of one’s choice.

Whole Foods Market To Debut ‘Daily Shop’ In Manhattan Later This year

Whole Foods Market (WFM), a unit of Amazon, earlier this month announced that it will open a new, quick-shop store format designed to provide customers in urban neighborhoods a quick, convenient shopping experience with easier access to the fresh offerings that can be found at its Whole Foods units.

The new format, called Whole Foods Market Daily Shop, will initially launch on the Upper East Side in Manhattan with additional locations in New York City to follow. The first store, located at 1175 Third Avenue, is expected to open later this year. Following the New York City launch, the company said Whole Foods Market plans to bring the format to other cities across the country.

Ranging from 7,000 to 14,000 square feet, the quick-shop stores are about a quarter to half the footprint of an average 40,000 square foot Whole Foods Market, paving the way for expansion in dense, metropolitan areas. In busy areas like Manhattan, the retailer is hoping to bring Whole Foods Market closer to existing customers, while extending the company’s reach to others in surrounding neighborhoods, the retailer noted.

The new Whole Foods Market Daily Shop will provide a convenient option for grab-and-go meals and snacks, weekly essentials, and a quick, easy destination to pick up ingredients to complete a meal – with all items meeting the company’s quality standards. Though smaller, the stores will still offer Whole Foods Market best-selling items, including a selection of fresh, seasonal produce, meat and seafood, prepared foods such as sandwiches and pre-packed meals, breads, alcohol, and supplements, as well as a handpicked range of local specialties and its own 365 by Whole Foods Market brand.

In addition, the location will be the first Whole Foods Market store in Manhattan to offer Juice & Java, a venue for coffee, tea, fresh pressed juices, smoothies, sandwiches, soups and various desserts.

“At our new store formats, we’re tailoring every square foot to the unique, fast-paced needs of urban lifestyles. We’re excited to introduce a new way for our customers to quickly pick up their Whole Foods Market favorites – from grab-and-go meals to that last-minute dinner ingredient – making the early morning or after work grocery trips more efficient and enjoyable,” said Christina Minardi, executive VP-growth and development, Whole Foods Market & Amazon. “Expanding our footprint with Whole Foods Market Daily Shop is key to our growth, fostering deeper customer connections, and advancing our purpose to nourish people and the planet.”

Minardi is a New Jersey native who also served as Northeast Region president for 12 years.

The new format stores will not replace the traditional Whole Foods Market store format. In 2023, Whole Foods Market added its 17th store in New York City at One Wall Street.

The new Daily Shop format also will not replace the company’s seven Manhattan Amazon Go stores, which are smaller (about 1,800 square feet) c-stores of which there are seven in Manhattan and 22 in the U.S.

Despite criticism of its multi-faceted grocery platforms, Amazon CEO Andy Jassy, speaking to financial analysts after last month’s strong Q4 earnings call, said he is “pleased with the progress we’re making” in the grocery segment of the business. That includes its Amazon Fresh locations, online sales of groceries through its website, and about 530 Whole Foods Market locations.

“It’s a big business, and it’s continuing to grow at a very healthy clip, and we’re really pleased with that business. And it’s really the way that most mass merchandisers got into the grocery business a few decades ago,” he said.

He added that the company began work last year remodeling select Amazon Fresh locations.

“If you want to serve as many grocery needs as we do, you have to have a mass physical presence, and that’s what we’ve been trying to do with (Amazon) Fresh over several years,” Jassy said. “We’ve been testing (version 2) of our Fresh format in a few locations near Chicago, and a few locations in Southern California. It’s very early, it’s just a few months in, but the results are very promising and on almost every dimension, and so we need to see it for a little bit longer time, but the results appear like we have something that’s resonating and if we continue to see that, then the issue becomes how fast and what’s the best way to expand.”