Food Trade News

Phillips Foods Ribbon Cutting For New Production Facility and Culinary Center

Family Owned Markets Reset: Adds Saubel’s, Switches To MDI

Family Owned Markets (FOM), the advertising and marketing group serving Central Pennsylvania independent retailers, has announced a major restructuring, said Jim Kidwell, director of marketing for the group’s four members – John Herr’s Village Market, Millersville, PA; Oregon Dairy, Lititz, PA; Yoder’s Country Market, New Holland, PA; and Martin’s Country Market, Ephrata, PA. The Millersville, PA-based entity will be adding a new member and switching wholesalers.

Family Owned Markets was created in 2003 to combine buying power and creative ideas to give its independent ownership (then all located in Lancaster County) greater marketing clout.

According to Kidwell, the recent restructuring stemmed from the reality of dealing with current competitive marketing conditions that have impacted the group as well as providing an opportunity for FOM to grow.

At one point, FOM members included Darrenkamp’s whose four-store operation was sold to Giant/Martin’s in 2018, and Ferguson & Hassler, whose lone unit in Quarryville, PA was also sold to Giant/Martin’s this past summer.

“This market has evolved rapidly over the past five years,” said the former food broker who has been involved with the grocery business in Central PA for nearly 30 years. “With the recent sale of the three Musser’s stores (also sold to Giant/Martin which will reopen them next month), we needed a new plan of action if we were to move forward.”

Almost immediately after the Musser’s sale was announced last month, Saubel’s Markets, a strong four-store independent with units in Pennsylvania and Maryland, elected to join the group. That increased FOM’s store count to eight and according to Kidwell, “We are in contact with other Central PA independents in attempt to further increase the membership.”

In a related announcement, Kidwell said that effective January 2020, the members of Family Owned Market will be switching primary suppliers. That’s when Merchant’s Distributors Inc. (MDI), the large privately-held voluntary wholesaler based in Hickory, NC, will begin servicing the group. FOM’s members had been supplied by C&S Wholesale Grocers since 2014 when the Keene, NH-based distributor acquired bankrupt AWI. Most of FOM’s members had been part of the AWI co-op for more than 40 years.

MDI, which has estimated annual sales of $2.1 billion and also owns the Lowe’s Food supermarket chain, has been adding new stores in the Mid-Atlantic region since AWI’s bankruptcy. With the addition of eight new stores, MDI’s presence in the regional field of wholesalers (which also includes UNFI and Bozzuto’s) becomes more impactful.

Asked if he was concerned about the logistical challenges posed by a company whose distribution center is based about 500 miles from Central PA, Kidwell said that is not a concern.

“MDI is currently running about 30 trucks to this area weekly, supplying its existing customers and utilizing backhaul opportunities, so I’m confident they can handle any logistical issues. I’m also optimistic that we’ll be able to get the same level of coverage – both at headquarters and in the stores – from the brokers and vendors,” he explained. “The key to our shift of wholesalers was that MDI made us feel comfortable. All the members were convinced that they understood the nuances of independent retailing and had a skilled staff who could best tend to our needs.”

LEGISLATIVE LINE

Congress may be on its summer break, but the machinery of government continues to change gears albeit slowly until our lawmakers are back in town after Labor Day. The Hill’s “power behind the throne” staff, however, continues to work hard to carry out the wishes of their Senators and House members. One issue in particular that is of major importance to our food industry is the Supplemental Nutrition Assistance Program (SNAP) or what is still referred to by us old timers as “food stamps.” There is a lot of new information coming out of Washington as the Trump administration continues to try to rein in broad-based categorical eligibility of SNAP.

The U.S. Department of Agriculture announced late last month a new proposed rule to crackdown on SNAP eligibility. The proposed rule provides for a 60-day comment period, so anticipate more debate and possible legislative or regulatory action in the early fall. While Democrats are generally opposed to the proposed rule, Republicans support changes and even a lengthy, recent editorial in the Wall Street Journal chimed in to say the time has come for some needed SNAP reforms. The proposed changes to SNAP will impact millions of recipients by pushing them off food stamps. At this time, about 40 million low-income people received SNAP benefits in 2018. Of that number, about 3 million people that reside in 43 states are routinely granted automatic eligibility for SNAP but are also receiving other government food subsidy benefits. Double dipping? Thus, the intent of the new rule is to ensure that recipients are treated equally across ALL states.

USDA says that the proposed SNAP changes will save taxpayers $9.4 billion over five years. For the food industry, the proposed rule may mean food stores will lose $3 billion annually in sales, according to USDA’s analysis. Politico reported that for a small food retailer, the potential benefit loss might make up less than 5 percent of their typical SNAP sales. Stay tuned!

Plant-Based Meat Substitute Labeling

New national TV network advertisements sponsored by Burger King are touting the availability of plant-based meat that is more affordable and accessible, and democratizing the alternative protein revolution. And in a related matter, the New York Times ran an extensive story at the end of July on the labeling battle between the traditional livestock-based meat industry and new, plant-based meat alternatives. The meat industry has witnessed the decline of the dairy industry (real milk versus soy alternatives) within their industry in the face of competition from plant-based alternatives and as I’ve previously reported, has vowed to prevent the same from happening to them. The meat industry is flexing its political muscles by having livestock friendly legislators introduce legislation in 24 states to restrict the use of meat terms – meat, burgers, steak, etc. – in labeling plant-based alternatives. Manufacturers of plant-based substitutes, with the help of the Good Food Institute, the Plant-Based Food Association, the ACLU and the Institute for Justice, are fighting back in the courts, accusing the state laws of violating their 1st and 14th Amendment rights. Stay tuned, this battle is just beginning. Oh, did I mention that Beyond Meat is developing a plant-based BACON substitute? This new technology is not a fad, ladies and gentlemen! It’s here to stay!

Cereal Makers Impact The Environment

FOOD Navigator-USA reports that the Union of Concerned Scientists (UCS) has published a study, “Champions of Breakfast,” that calls upon General Mills, Kellogg, Post and Quaker Foods to use their market leverage in buying grain to push grain farmers to adopt regenerative agriculture practices more quickly to help the environment. UCS argues that growing grain, which is extensive in the U.S., “is highly damaging to the environment. And it is a significant cause of water pollution, soil erosion, biodiversity loss and heat-trapping emissions.” The study suggests that slight changes in sourcing standards for specific grains by the four cereal giants could have a dramatic, positive impact on the environment. This is another example of agriculture being singled out more and more as a major environmental player.

In my column last month, I highlighted my personal observations on climate change after attending a Smithsonian Environmental Research Center lecture in Edgewater, MD. Now the United Nations has issued a warning, one that I previously said was coming, of mass food insecurity from climate change. The report from the U.N.’s Intergovernmental Panel on Climate Change, released just weeks ago according to Politico, laid out a dire future for the agriculture industry if climate change isn’t adequately addressed. Rising temperatures will intensify droughts, floods and heat waves (we sure did experience all three over the past few months in the U.S. alone) and at the same time, we will experience soil loss and degradation, according to the report. It also found climate change is leading to decreased yields and lost land from erosion. Researchers cited the industrial agriculture industry as a major contributor to rising greenhouse gases, pointing to methane emissions from livestock and draining of wetlands.

Evidence Of Sesame Allergies

The FDA Law Blog reports that new evidence of widespread, severe sesame allergies in the U.S. could convince the agency to add sesame to the list of major food allergens that must be declared on food labels. A new story, “Prevalence and Severity of Sesame Allergy in the United States,” published in JAMA Network Open, finds that 2.6 million people or 0.83 percent of the U.S. population have a sesame allergy.

Food Packaging

Politico’s Morning Agriculture reported that Chemours, a chemical firm that makes Teflon, has announced that it has stopped making nonstick coatings used in food packaging. It had made three products containing PFAS (polyfluoroalkyl substances are a group of man-made chemicals) used in food packaging to resist oil and grease. The use of PFAS in food packaging had been approved in the past by FDA, but the agency recently announced that it was going to review its approvals considering new evidence that suggests these chemicals may be dangerous.

CBD Infused Beverages Delayed

We at Policy Solutions LLC continue to follow CBD issues for our clients. Recently, FOOD Navigator-USA reported that New Age Beverages of Colorado has delayed the introduction of its Marley brand CBD infused beverages because of the “regulatory uncertainty over CBD.” The FDA has been very clear that CBD infused food and beverages cannot be sold legally in interstate commerce.

FDA Boot Camp

It still is not too late to sign up to attend the American Conference Institute’s popular ”FDA Boot Camp” – now in its 34th iteration and slated for September 18-19 at the Bostonian Hotel in Boston. The conference is billed as the premier event to provide attendees with a roadmap to navigate the difficult terrain of FDA regulatory law. Let your food safety people know of this upcoming seminar.

You can find out more information and register by contacting ACI at 888.224.2480 [email protected].

Back To Work

Congress will soon be back from its summer break and there will be lots of activity on the Hill to decipher. And with the elections not that far off, there promises to be lots of heightened interest in new laws and regulations to win over voters. If we can be of assistance to you as you try to get through the “smokescreens,” drop me a note. We have tremendous contacts on the Hill to help you and your business.

Barry Scher is associated with the public policy firm of Policy-Solutions LLC and may be reached at [email protected].

Giant, Safeway Set To Bargain Labor Pacts With UFCW Locals

Representatives of the two largest retail chains in the Baltimore-Washington market – Giant and Safeway – have begun bargaining with the area’s two United Food and Commercial Workers unions – Local 400 and Local 27 – as all sides seek new labor contacts for their retail clerks and meatcutters. The current three-year agreement expires on October 26.

All told, approximately 26,000 store associates (15,000 at Giant and 11,000 at Safeway) are impacted. As was the case in 2016 when the two large chains negotiated their last agreements, Giant and Safeway will bargain their contracts separately. Prior to that, the two chains negotiated UFCW labor pacts as one combined entity for more than 40 years.

Sources from both sides agreed that the focus of these negotiations will center on reducing the huge unfunded liability of their “FELRA and UFCW” multi-employers pension fund which impacts approximately 35,000 current and retired clerks and meatcutters at both chains. That shortfall now exceeds $1 billion, one of the largest unfunded amounts of any pension plan in the nation. Giant and Safeway associates comprise a majority of the plan’s members.

“Both sides have been kicking this can down the road on this issue for years,” said a union executive involved with these negotiations. “Obviously, this is a national issue that’s very complex; there are no quick-fix solutions. However, in the case of the FELRA (Food Employers Labor Relations Association) plan, the unfunded liability continues to grow each year and I believe we’re within a few years of insolvency. Both sides need to find a way to compromise to reduce this massive liability.”

Other issues on the table include healthcare benefits and wages. In 2016, both UFCW locals were able to avoid “givebacks” on healthcare. However, as the cost of maintaining health benefits continue to rise, look for this to be a key issue for both sides.

Wages, too, promise to be an important item that will be on the table over the next six weeks. In 2016, clerks and meatcutters gained an average compensation increase of $3.35 an hour (wages and benefits).

Safeway and Giant believe that they are at a competitive disadvantage when compared to other food and drug retailers in the Baltimore-Washington which are not unionized (the only other major organized retailer in the market is Shoppers which is selling its stores). As such, both chains feel that non-union retailers can afford a higher hourly wage because they are not responsible for paying the same benefit load as the two leading chains in the market. It’s the classic chicken/egg argument that once again will be addressed during the bargaining

The unions feel differently, noting that Giant and Safeway’s inability to offer (in some cases) the same wage levels as their non-union rivals has contributed to a weakened labor pool, causing more turnover which ultimately impacts store level perception.

According to one retail executive whose company is involved in the negotiations: “You can’t have it both ways. We have to look at this issue by examining our total cost of labor – not just wages. It’s true, that the labor pool is not strong today, but there are several reasons why including an exceptional level of unemployment. We just can’t keep paying more when we recognize that more than half of the Baltimore-Washington market is now comprised of non-union competition whose total compensation package is less than ours.”

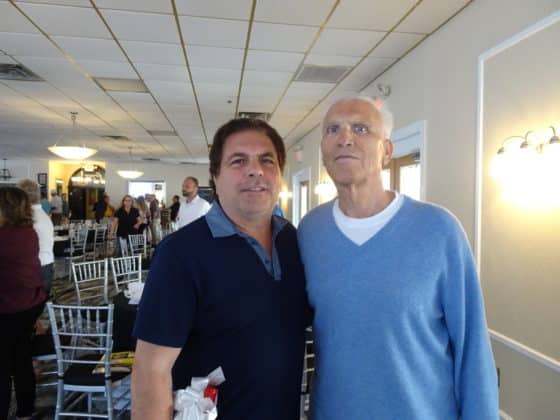

Mike McCann, Former Balt-Washington Food Broker, Dies at 81

Michael Joseph McCann Jr., retired food broker and a major presence in the Baltimore-Washington market for more than 30 years, passed away last month at the age of 81.

Born in Philadelphia and raised in Laurel Springs, NJ, McCann graduated from Camden Catholic High School and attended Saint Joseph’s University in Philadelphia. His first food industry job was working in the stores for Acme Markets while still in high school in the late 1950s. After college, he began his full-time career as a sales rep for Hudson Paper. In the early 1970s, he relocated to the Baltimore-Washington area and soon formed his own food brokerage, McCann Sales based in Millersville, MD.

In 1991, he merged his business with RMI, Inc., the large food brokerage organization led by Dick McCready. McCann and McCready went on to form new brokerage affiliates including CBS/McCready Marketing, REM and Advantage/ESM where McCann held the roles of either president or vice chairman.

McCann retired from the business in 2006.

In his retirement years he continued to live in Queenstown, MD on the Eastern Shore with his wife Mackie. He enjoyed boating (he belonged to the Annapolis Yacht Club for more than 50 years), golfing and skiing.

Mike McCann is survived by his wife; three sons – Michael, Kevin and Brendon; five grandchildren; one great-grandchild; and two brothers.

Amazon Testing Hand ID Payment System For Whole Foods

According to a recent article in the NY Post, Amazon is testing out new biometric technology that will scan the size and shape of a customer’s hand for a speedier checkout at Whole Foods. The system, which will utilize computer vision and depth geometry to identify the unique dimensions of a customer’s hand, will identify shoppers with Amazon Prime accounts and will link to their debit or credit card on file.

The technology is reportedly being tested at Amazon’s New York offices with select vending machines utilizing the hand biometric system for purchase of snacks, sodas, and phone chargers.

If beta tests are successful, it is expected that the technology will be in select stores by early next year, eventually expanding to all Whole Foods locations in the U.S.